indiana estate tax threshold

The top estate tax rate is 16 percent exemption threshold. The tax rate increases to 16 for.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing address.

. The annual gift tax exclusion amount jumps to 16000 for 2022 up from 15000 where it sat since 2018. If you have more questions about sales tax you may call our sales tax information line at 317-232-2240. For instance if your taxable estate is 15 million then after the 117 million credit 33 million is taxable.

In 2022 an individual can. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. 10 of the unpaid tax liability or 5 whichever is greaterThis penalty is also imposed on payments which are required to be remitted electronically but are.

If you were a full-year resident of Indiana and your gross income the total of all your income before deductions was more than your total exemptions claimed then you. Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax is Due on the Transfer Form IH-TA and notices that life insurance proceeds have been paid to an. In Indiana there are several ways that estate administration can be handled depending on the level of supervision required and the amount of assets in the estate.

In Indiana these assets will avoid probate if other assets outside the trust exceed the states small estate threshold. This entire sum is taxed at the federal estate tax rate which is currently. No estate tax or inheritance tax.

The Indiana personal exemption includes a 1500. The average income tax rate for counties and large municipalities is 116 according to the Tax Foundation weighted by income. Example Juanita is opening a computer store where shell sell components parts.

Understanding the Indiana Probate Process. Indiana Department of Revenue. Illinois has an estate tax on estates over 4 million.

For example amounts of at least 40000 but less than 90000 have a tax rate of 08 -- but only if the estate is worth more than 4 million. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Note that for tax years 2020 and 2021 Texas Margins Tax provides for a no tax due threshold of 118 million of gross receipts.

Up to 25 cash back Indiana Estate Planning. Whats new for Estate Taxes in 2022. Failure to pay tax.

The Estate Tax is a tax on your right to transfer property at your death.

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

A Guide To The Federal Estate Tax For 2021 Smartasset

2015 Estate Planning Update Helsell Fetterman

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

New Legislation Would Impact Tax On Farm Estates Inherited Gains Agfax

State Estate And Inheritance Taxes

Inheritance Tax Here S Who Pays And In Which States Bankrate

Indiana Inheritance Tax Free Download

State Estate And Inheritance Taxes Itep

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

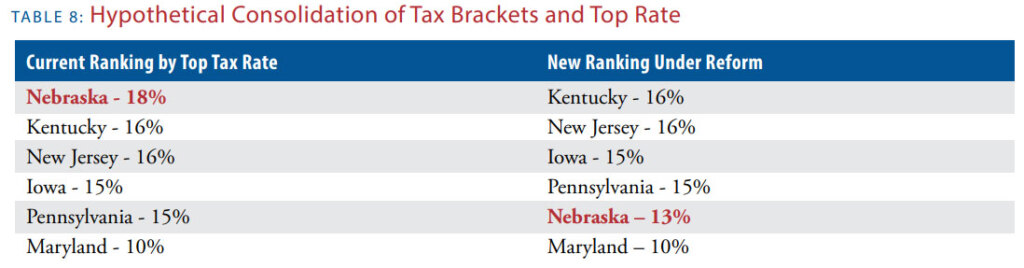

Death And Taxes Nebraska S Inheritance Tax

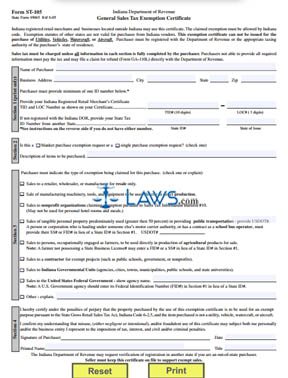

Free Form St 105 General Sales Tax Exemption Certificate Free Legal Forms Laws Com

How Many People Pay The Estate Tax Tax Policy Center

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger